AI in Commercial Real Estate

February 19, 2026

AI in Commercial Real Estate

February 19, 2026

At Smart Capital Center, we are convinced that the future of commercial real estate (CRE) investing hinges on rapid, precise, and intelligent operations at scale. Our latest webinar united top investment firms and underwriting teams nationwide—from institutional investors to asset managers—for a live showcase of AI-driven underwriting in practice.

The session featured a real-world retail case study: La Jolla Village Square, a landmark shopping center located in San Diego, California. By applying AI and Deep Research to this asset, we showcased how underwriting can move from days of manual reconciliation to real-time analysis, empowering teams to underwrite much faster, with confidence.

“Smart Capital Center is specifically crafted for commercial real estate, unlike general AI tools. Each feature—from processing financial data to tracking risks—is tailored for CRE documents, workflows, and investment scenarios.” - Hannah Kidd, Senior Financial Associate, Smart Capital Center

Here are the key takeaways from this session:

Traditional underwriting requires countless hours of manual data entry, reconciliations, and document review. Smart Capital Center ingests and standardizes financial statements, rent rolls, appraisals, and OMs in minutes.

Every analysis remains fully transparent and subject to analyst review. Firms can customize their underwriting process. This helps them keep their unique models and benchmarks. They can also speed up the manual steps that slow down execution.

Analysts retain full transparency — every data point links back to its source document — while gaining immediate variance analyses, visualizations, and reconciliations.

“You can think of us as your co-pilot in commercial real estate — helping you make smarter, faster decisions with real-time data, AI-powered underwriting, and unmatched market intelligence.” – Garrett Brewer, Director of Sales, Smart Capital Center

Smart Capital Center isn’t just a point solution. It’s an end-to-end platform covering origination, underwriting, portfolio monitoring, loan management, risk analysis, and disposition. By embedding AI across the investment lifecycle, firms can process more deals, identify risks earlier, and execute faster.

Smart Capital clients — including JLL, RMR Group, Tremont, and KeyBank — are already seeing this transformation. These teams are streamlining their workflows with AI-powered underwriting, real-time market intelligence, and automated reporting that replaces hours of manual work with transparent, source-linked insights.

Generative AI goes beyond data extraction. Smart Capital Center continuously scans market data, regulatory shifts, and tenant news to surface signals that would be nearly impossible to track manually at scale. For example, if a major retailer like Nordstrom declares bankruptcy, the system proactively flags which properties and portfolios are impacted.

This is especially powerful in two critical workflows:

The result: workflows shift from reactive to proactive, in real-time. Teams gain intelligence to protect cash flow, mitigate tenant risk early, and uncover opportunities long before competitors.

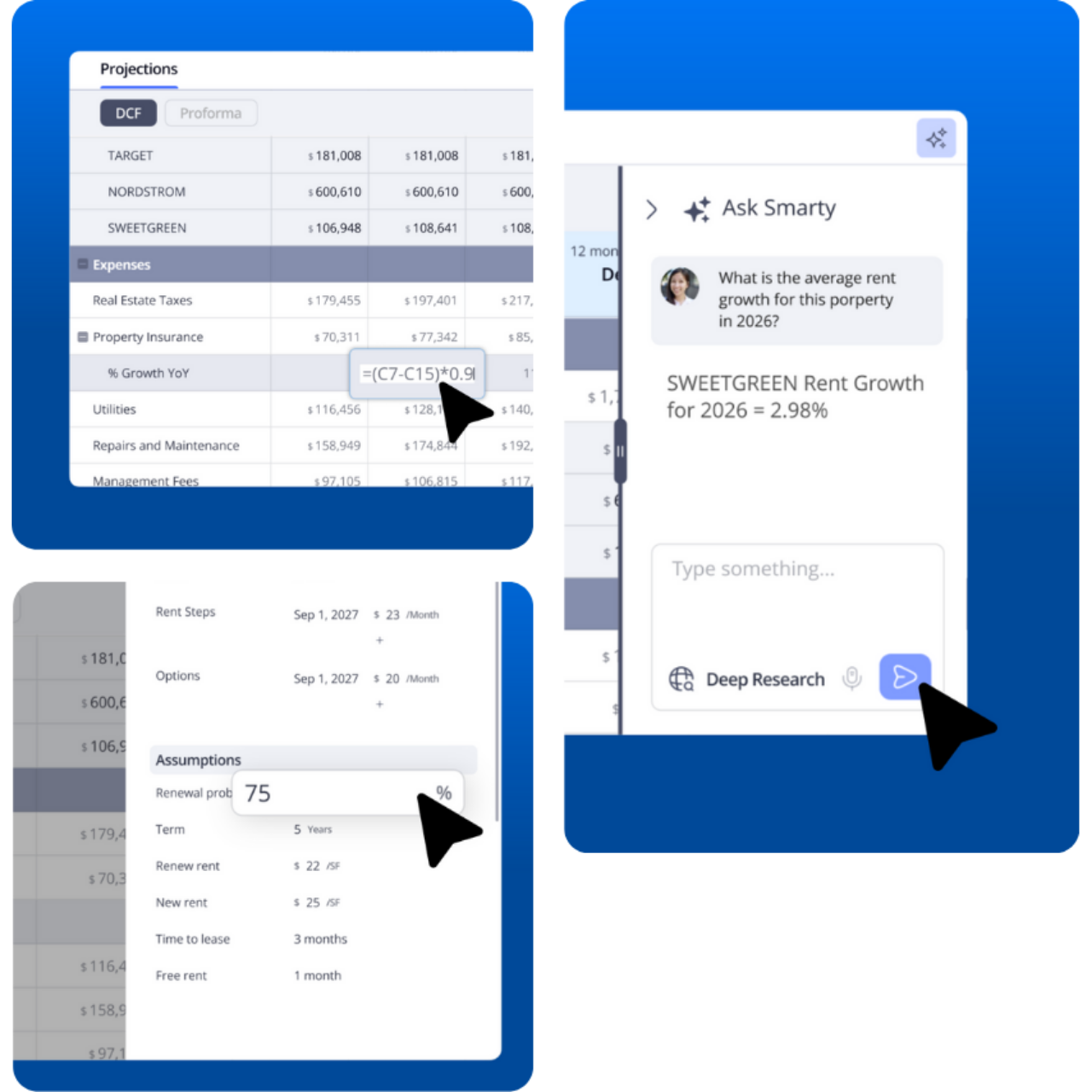

Meet Smarty, the AI analyst built specifically for CRE. Unlike a generic chatbot, Smarty has full context of your portfolio, properties, tenants, and financials. It doesn’t just retrieve data — it reasons over it, runs scenarios, and explains results in plain language.

Instead of weeks of back-and-forth analysis, Smarty enables on-demand, institutional-grade answers in seconds. For CRE investment teams managing hundreds of properties, the scale is unmatched: one AI Smarty assistant effectively functions like 100 analysts working around the clock, delivering immediate insights without increasing headcount.

Smart Capital Center equips teams with a limitless AI workforce — 100x agents working around the clock. This doesn’t replace people; it empowers them. Underwriters and analysts shift from repetitive tasks to higher-value decision-making.

Early adopters of the software such as KeyBank are reporting dramatically faster financial model preparation and significant time savings across underwriting workflows.

Clients like JLL, RMR Group, and KeyBank are experiencing measurable, game-changing results with Smart Capital Center.

Fernando Salazar, Director of Asset Management at JLL, shared:

“Instead of the 30–40 minutes it took us previously to process a single financial statement, now it takes 1–3 minutes with Smart Capital Center.”

That’s a 30x productivity gain in one of the most repetitive but critical workflows of underwriting and asset management.

Other early adopters are reporting similar impact:

These gains translate directly into scale, speed, and ROI. Analysts and asset managers shift from manual data entry to higher-value decision-making. Firms move from reactive monitoring to proactive intelligence. And leadership teams gain the confidence of knowing every decision is grounded in source-linked, AI-powered analysis.

In the live demo at La Jolla Village Square, Smart Capital Center showed a complete property history. This history included changes in ownership and mortgage records. This included detailed market information like demographics, business stats, location popularity, amenities, and foot traffic. All of this was combined into one clear market view.

Tenant analytics added another dimension by enabling real-time monitoring of financial exposure, tenant operating and financial performance, industry health, and even online sentiment.

“If there’s any negative news affecting a tenant, the analyst or asset manager gets notified right away so you can act immediately.” – Hannah Kidd, Senior Financial Associate, Smart Capital Center

Traditional DCF models depend on fixed assumptions. These include rent growth, occupancy rates, operating costs, and market comparisons. These assumptions often do not match current conditions. Smart Capital Center transforms this process by embedding Deep Research directly into underwriting.

With Deep Research, you can test every DCF assumption. You can compare it to real-time market data, benchmarks, research reports, and local comps. For example, when analysts predict revenue growth or expense ratios, the system checks inputs against many similar properties. It uses data from the same submarket, recent reports, online sources, and linked proprietary databases.

The result is underwriting that is no longer based on old assumptions. It is now grounded in current, local, and evidence-based information.

This mix of DCF modeling and AI Deep Research offers a level of accuracy that manual methods can't match. Underwriting changes from a “best guess” to a data-driven process. This helps firms price risk more accurately. It also helps them find hidden opportunities in their assumptions.

The system automatically builds pro formas and DCFs while integrating seamlessly with existing Excel models, Argus, or other databases. This allows analysts to maintain their familiar workflows while gaining the benefits of automation and full transparency.

All results can be exported back to Excel, ensuring investment teams can continue to use their preferred models and reporting templates without disruption.

Generative AI further enhances financial analysis by comparing performance across periods and explaining the underlying drivers of change. For example, the system can highlight whether a variance stems from seasonal utility costs, tax adjustments, or other operating factors—turning raw numbers into actionable insight.

Financial analysis is more than just pulling together statements—it’s about explaining what’s happening, anticipating what’s coming, and giving teams actionable insight. Smart Capital Center applies AI to do exactly that across underwriting, monitoring, reporting, and risk management.

Why the AI shift to financial analysis matters:

Financial analysis is no longer just about understanding the past—it’s about influencing the future. When you know why numbers changed, you can predict better.

You can also adjust your models or DCF. This helps you act before small issues turn into big problems. That means more defensible valuations, more accurate underwriting, and greater agility in portfolios.

"Smart Capital Center is made just for commercial real estate. Every insight, like rent rolls or tenant exposure, is designed for real estate investing." This ensures analysis is not just fast, but also contextually relevant to acquisitions, and asset management.” - Garrett Brewer, Director of Sales, Smart Capital Center.

A frequent question: Is my data safe?

Yes. At Smart Capital Center, we understand that for CRE firms, data security isn’t optional—it’s foundational. Our platform has strong protections for businesses. It follows strict rules and ensures clear accountability at every level.

“All the information you upload is secure and just for you. We currently work with regulated entities such as banks, insurance companies and government agencies.” – Garrett Brewer, Director of Sales, Smart Capital Center

"This flexibility lets CRE investors choose how to use AI in their underwriting and asset management. This way, their unique methods stay private and under their control." - Hannah Kidd, Senior Financial Associate, Smart Capital Center

AI is changing how companies handle commercial real estate (CRE) underwriting and asset management.

It helps firms shift from reacting to situations to using proactive intelligence. Smart Capital Center helps teams see risks and act on chances right away. They do not wait for quarterly reports or old data.

With Smart Capital, investment teams gain a proactive edge through:

The result is a shift from slow reactions to quick decision-making. This helps CRE firms protect their returns, act faster on deals, and find opportunities before their competitors.

AI in CRE isn’t a someday story—it is here now. With Smart Capital Center, acquisitions, underwriting and asset management evolve from manual, reactive processes to real-time, proactive intelligence.

Investment teams see clear benefits. They can process finances 30 times faster. They also spend up to 80% less time preparing models. This happens while keeping human judgment, unique methods, and current workflows intact.

The platform is made for commercial real estate. It helps investors, asset managers, and lenders make quick decisions. They can grow confidently and find opportunities before their competitors. The future of underwriting lies in real-time deep research—and it has already begun.

If you want to see how AI underwriting can improve your workflow, schedule a demo with our team today.